Adults behind with bills at different levels of income

5 September 2023

Key points

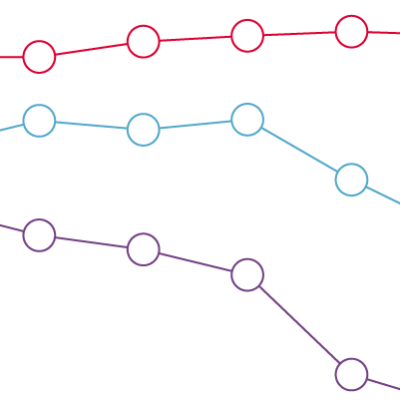

- In 2020/21, the proportion of households behind with their bills was highest for people on the lowest incomes (the bottom fifth) at 11.5% and lowest for people on the highest incomes (the top fifth) at 1.2%.

- This represents a decrease since 2009/10 (14.7% for households on the lowest incomes), but a slight increase compared to 2015/16 (9.9%). The proportion of households behind with their bills in the middle fifth and top fifth of incomes has remained stable since 2010/11.

- During the cost of living crisis other more timely surveys indicate a significant increase in the share of households behind with their bills.

Being in problem debt can harm people’s physical and mental health by causing strain and stress, reducing income available for products and services that promote good health, or increasing health-harming coping behaviours. Poor health can also increase the possibility of problem debt, for example when someone loses their job or has a low income. This can create a cycle of problem debt and poor health. Falling behind with bills can be both a cause and consequence of problem debt.

This chart shows the proportion of households at different levels of income that were behind with bills from 2010/11 to 2020/21. ‘Behind with bills’ includes people who are either behind with ‘some bills’ or behind with ‘all bills’.

- The proportion of working-age adults who are behind with bills is much higher in households in the bottom 20% of incomes than in the middle or top 20% of incomes, fluctuating between 10% and 15%.

- In comparison, the proportion in the top 20% of incomes has fluctuated between 0.5% and 1.4% since 2010/11.

More recent survey data, designed and analysed by Resolution Foundation and supported by the Health Foundation, has indicated a growing share of households are behind with bills due to the cost of living crisis, while other common coping strategies are either relying on savings or taking on other forms of debt, e.g. use of credit cards. In March 2023 12% of adults reported they fell behind on one or more important bills.

Working-age people on lower incomes are more likely to be behind with bills than people on higher incomes. Increasing social security support and cost of living payments have helped support people on low incomes, but sustained high price levels for essentials risk pulling more people into problem debt.

- The income quintiles are based on net equivalised (adjusted for household size) household income after housing costs have been deducted from income. People are grouped into five equal-sized bands (quintiles). Quintile 1 represents the lowest 20% of incomes and quintile 5 represents the highest 20%.

- People were asked whether they are up to date with all their household bills, such as electricity, gas, water rates, telephone and other bills, or whether they are behind with any of them. The options include ‘up to date with bills’, ‘behind with some bills’ and ‘behind with all bills’. In this analysis, ‘behind with bills’ is a combination of people who are behind with some bills and behind with all bills.

Source: Health Foundation analysis of University of Essex - Institute for Social and Economic Research, Understanding Society, UK, 2009/10 to 2020/21