Key points

- Among people in problem debt, nearly half (46%) say their health is ‘less than good’ (fair or poor) compared to only 23% who are not experiencing problem debt.

- People who are not in problem debt are almost twice as likely to have very good health compared to people who are (35% compared to 19%).

Being in problem debt can harm people’s physical and mental health by causing strain and stress, reducing income available for products and services that promote good health, or increasing health-harming coping behaviours. Poor health can also increase the possibility of problem debt, for example when someone loses their job or has a low income. This can create a cycle of problem debt and poor health.

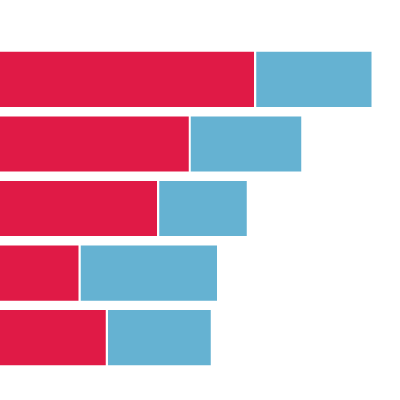

This chart shows the health (self-reported) of people who are in, and not in, problem debt and aged between 16 and 64 in 2018–20.

On average, working-age people in problem debt report worse self-rated health than people who are not in problem debt.

- Nearly half of people in problem debt say their health is fair or poor (46%) and about a fifth (21%) say it is bad or very bad.

- Among people who are not in problem debt, 23% say their health is fair or poor, and only 7% report having bad or very bad health.

- People not in problem debt are almost twice as likely to have very good health compared to people who are in problem debt (35% compared to 19%).

The relationship between problem debt and health remains once age and income have been accounted for, so it is not solely a result of people with problem debt having lower incomes or being a particular age.

People in problem debt tend to have worse health than people who are not in problem debt. It is important therefore to acknowledge the role of poor health in triggering and exacerbating debt. Specifically, there are questions on how to ensure debts remain manageable without becoming a problem as well as ensuring debt services are appropriate and accessible for people with health conditions.

A household is defined as being in problem debt if it falls into one – or both – of the following two groups:

- Liquidity problems:

- household debt repayments represent at least 25% of net monthly income, and at least one adult in the household reports falling behind with bills or credit commitments, or

- the household is currently in two or more consecutive months’ arrears on bills or credit commitments, and at least one adult in the household reports falling behind with bills or credit commitments.

- Solvency problems:

- household debt represents at least 20% of net annual income and at least one adult considers their debt a heavy burden.

Source: Health Foundation analysis of Office for National Statistics, Wealth and Assets Survey, Great Britain, 2018–20. This analysis uses financial debt, which is the money owed on credit cards, loans and other non-mortgage debt but excludes property debt and council tax. Self-rated health – where people are asked to assess their overall health – is a good proxy for health outcomes generally. Self-rated health is a measure of health on a five-point scale from ‘very good’ to ‘very bad’. The other options are ‘good’, ‘fair’ and ‘bad’.