Problem debt and the burden of debt, by income

4 September 2023

Key points

- On average, working-age people living in higher-income households are less likely to experience problem debt or to feel that their debt is a heavy burden than in lower-income households.

- 17% of working-age people on the lowest incomes (the bottom tenth of incomes) live in a household with problem debt, compared to just 1% in households on the highest incomes (the top tenth).

- Almost a quarter (23%) of working-age people on the lowest tenth of incomes live in a household where at least one adult considers their debt a heavy burden. This drops to just 1.5% in the top tenth of income.

Being in problem debt can harm people’s physical and mental health by causing strain and stress, reducing income available for products and services that promote good health, or increasing health-harming coping behaviours. Poor health can also increase the possibility of problem debt, for example when someone loses their job or has a low income. This can create a cycle of problem debt and poor health.

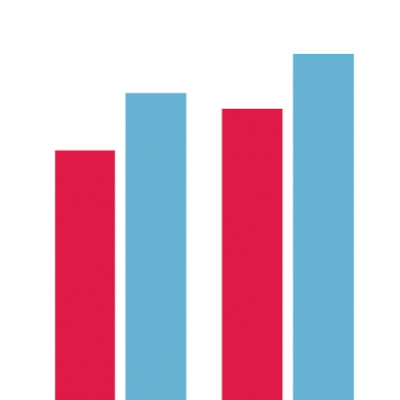

This chart shows the proportion of people living in a household with problem debt and the proportion who are living in a household where at least one adult feels their debt is a heavy burden, for each income decile in 2018–20. People are grouped into 10 equal-sized bands (deciles) based on their equivalised income (adjusted for household size) after housing costs.

- Working-age people on lower incomes are more likely to be in a household experiencing debt problems or be at risk of experiencing debt problems in the future than people on higher incomes.

- In the lowest tenth of incomes, 17% live in a household experiencing problem debt, while in the top tenth, only 1% live in a household experiencing problem debt.

- In households on the lowest tenth of incomes, 23% consider their debt a heavy burden, compared with 15% on the next tenth of incomes and just 1.5% on the highest tenth of incomes.

- The proportion of respondents who consider their debt a heavy burden falls between each income decile from poorest to richest, except between the fourth and fifth tenths, where there is a slight increase.

Our analysis on debt and health, which looks at how likely people are to be in debt in each fifth of income (rather than each tenth), shows that people on the lowest fifth of incomes are less likely to be in debt – around 45% compared with over 60% on the second-highest fifth. But people who do are more likely to spend a higher proportion of their income on debt repayments. In the lowest fifth of incomes, 18% spend more than 20% of their income on repayments, and nearly one in ten (9%) spend over 40%. For people on the highest fifth of incomes the equivalent figures are 9% and 3%.

Working-age people on lower incomes are more likely to experience problem debt or to feel that their debt is a heavy financial burden. A better specified and permanent version of the government’s household support fund could help reduce the number of people seeking inappropriate debt products such as doorstep lenders and high-interest credit to keep up with costs that are hard to manage on a low income.

A household is defined as being in problem debt if it falls into one – or both – of the following two groups:

- Liquidity problems:

- household debt repayments represent at least 25% of net monthly income, and at least one adult in the household reports falling behind with bills or credit commitments, or

- the household is currently in two or more consecutive months’ arrears on bills or credit commitments, and at least one adult in the household reports falling behind with bills or credit commitments.

- Solvency problems:

- household debt represents at least 20% of net annual income and at least one adult considers their debt a heavy burden.

This analysis uses financial debt, which is the money owed on credit cards, loans and other non-mortgage debt but excludes property debt and council tax.

A person is classed as living in a household that considers their debt a heavy burden if they live in a household where at least one adult considers their debt a heavy burden. This is a purely subjective measure.

- People were asked: ‘Thinking about the [overdraft(s)/credit card(s)/store card(s)/ credit agreement(s)/loan(s)/bill payments] you have just told me about, to what extent is keeping up with the repayment of them and any interest payments a financial burden to you?’ This analysis looks at the proportion of all respondents who live in a household that finds debt repayments a ‘heavy burden’. Other options include ‘somewhat of a burden’ and ‘not a problem at all’. It is taken from part 2 a) of the household problem debt calculation above.

The income deciles are based on net equivalised (adjusted for household size) household income after housing costs have been deducted from income. People are grouped into 10 equal-sized bands (deciles). The first decile represents the lowest 10% of incomes and the tenth decile represents the highest 10% of incomes.

Source: Health Foundation analysis of Office for National Statistics, Wealth and Assets Survey, Great Britain, 2018–20.