- In response to growing evidence of the role of sugar consumption in health problems such as obesity, a Soft Drinks Industry Levy (SDIL) is being introduced in 2018.

- Within soft drinks, about half the sugar people purchase from shops comes from drinks in the highest tier of the levy – taxed at 24p per litre. About a third comes from fruit juices – which are exempt from the tax.

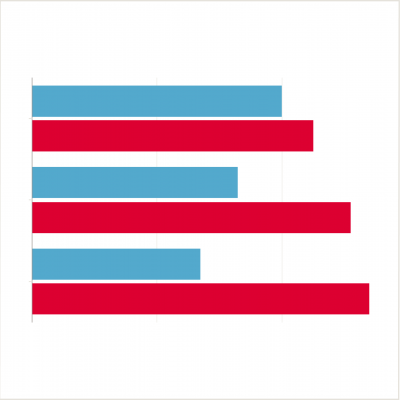

- People’s purchasing behaviour varies across different income groups – with lower earners typically getting more of their sugar from high sugar drinks, and higher earners typically getting more from fruit juices.

In an attempt to slow the growing issues with diet-related illness in the UK, the SDIL is being introduced in April 2018, aimed at changing producer behaviour. This is a tiered levy, with a zero rate for drinks below 5 grams of sugar per 100ml, a main rate for drinks above 5 grams of sugar per 100 millilitres and a higher rate for drinks with more than 8 grams of sugar per 100 millilitres. The Treasury were originally expecting the levy to raise £1.5bn in its first three years of operating (2018-2021), but these estimates have since been revised down to the Treasury’s assessment of changing industry behaviour. There are exemptions for milk-based drinks, as well as fruit juices.

The majority of sugar people purchase at shops comes as part of the food they buy. Some also comes from milk and alcohol. When it comes to soft drinks - such as colas, fruit juices, and waters – about half of people’s sugar comes from high sugar drinks. These are the drinks which will fall in the top tier of the SDIL, with over 8g of sugar per 100ml. Significantly less of people’s take home sugar purchasing comes from the lower tier of the tax, drinks which have between 5g and 8g of sugar per 100ml. The second biggest group is fruit juices, such as orange juices or pure fruit smoothies. These account for about a third of the sugar people purchase as part of take home soft drinks. These fruit juices are exempt from the tax.

Different income groups tend to have different purchasing habits, and this is true when it comes to take home soft drinks. The lowest income bracket have about 54% of their sugar coming from the high sugar soft drinks, 9 percentage points more than the top income bracket. In contrast, 40% of the top income bracket’s sugar comes from fruit juices, 13 percentage points more than the lowest income bracket.

Work with us

We look for talented and passionate individuals as everyone at the Health Foundation has an important role to play.

View current vacanciesThe Q community

Q is an initiative connecting people with improvement expertise across the UK.

Find out more